texas estate tax exemption

The amount of the exemption varies depending on the disabled veterans disability rating. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

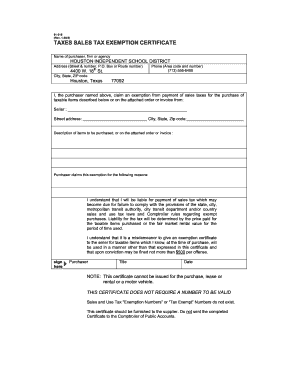

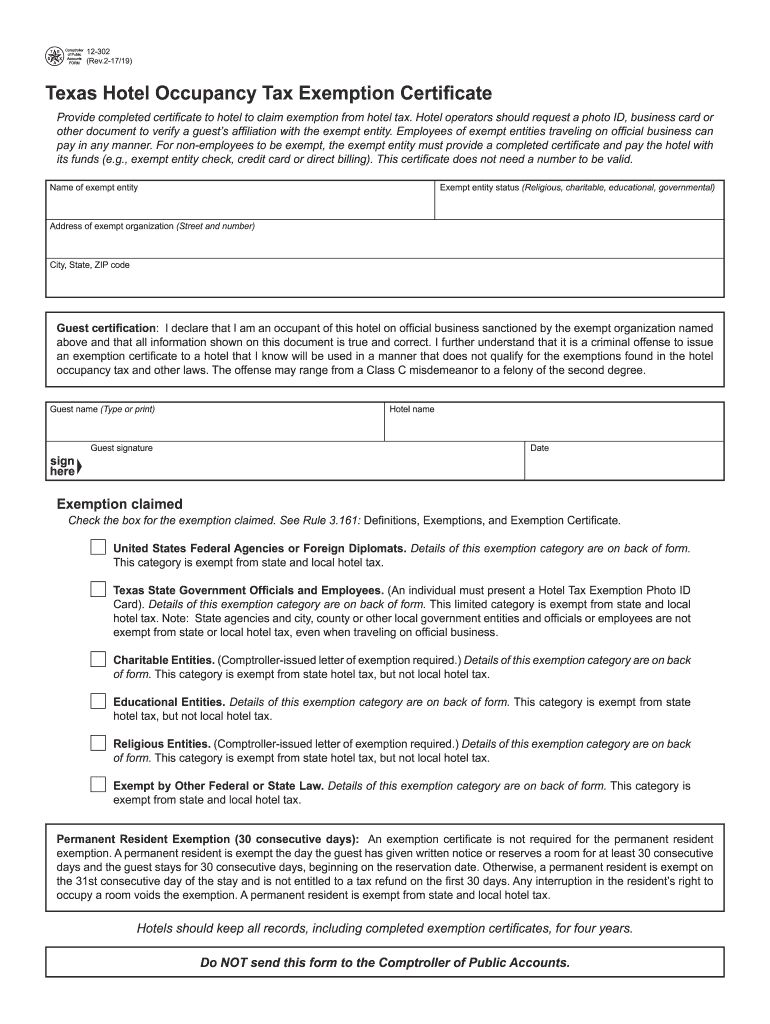

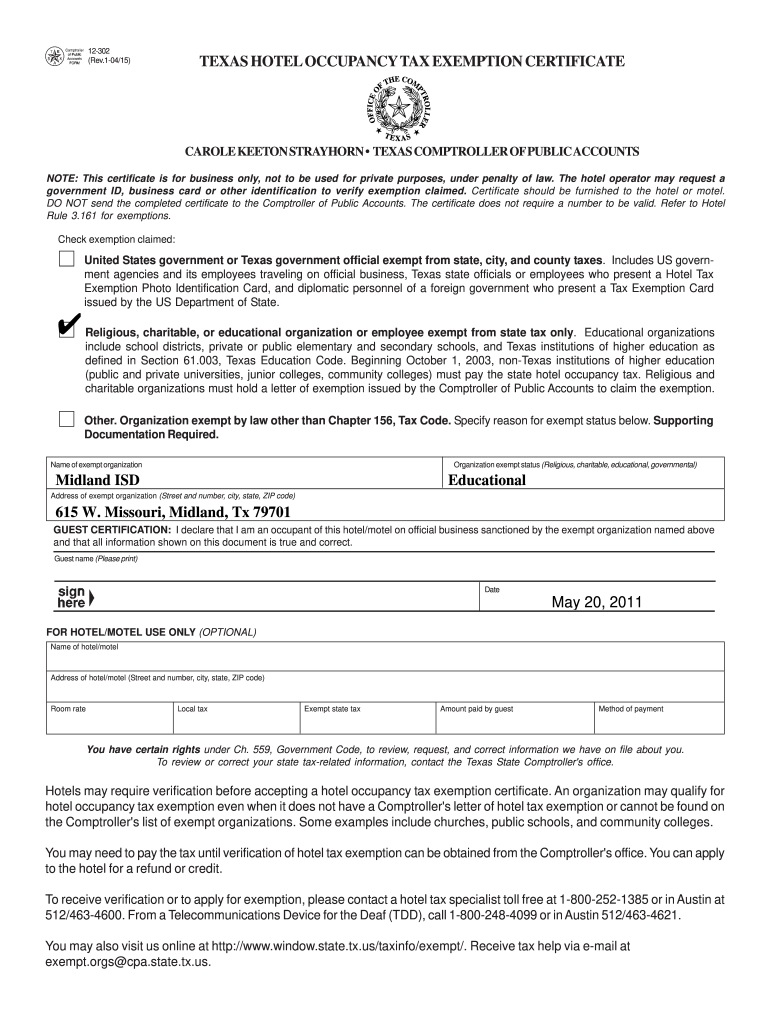

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

The exemption will be added to the existing 25000 homestead exemption.

. The Federal estate tax exemption for 2022 is 1206 million per individual 2412 million for married couples. Age 65 or older and disabled exemptions. The surviving spouse who remains unmarried and surviving children of a disabled veteran may also qualify for an exemption under this section.

Senior Property Tax Exemptions in Texas. In case youre not eligible for a veteran exemption you may qualify for other property tax exemptions in Texas such as. 1 You must ownoccupy your home.

However in 2022 the exemption limit has increased to 1206 millionor 2412 million for a married couple. The Estate Tax is a tax on your right to transfer property at your death. Tax Code Section 1122 provides a partial exemption for any property owned by a disabled veteran.

1 homestead exemption for school taxes. During an individuals lifetime or. Disabled Veteran Exemption Tax Code Section 1122 provides partial exemptions for any property owned by disabled veterans and surviving spouses and children of deceased disabled veterans and Tax Code Section 11132 provides a partial exemption for residence homesteads donated to disabled veterans by charitable organizations that also extends to surviving spouses who have.

Property Tax Exemption for Texas Veterans. Solar property tax exemption. The lifetime estate and gift tax exemptionalso known as the unified tax creditallows people to make tax-free transfers up to a certain amount during their life and upon their death.

Department of Veterans Affairs VA due to a 100 percent disability rating or determination of individual unemployability by the VA. The rates will start around 40 but there is recent discussions about increasing that rate and also decreasing the exemption. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF.

Election day is Saturday May 7 2022 so make sure you vote. The current amount is 1206 million. In 2021 if an estate was worth less than 117 millionor 234 million for a married couplethen the estate would not be taxed.

The primary residence of the applicant. Seniors older than 65 or disabled residents. This means that when someone dies and the value of their estate is calculated any.

DoNotPays Property Tax guide will show you which exemptions you can apply for and how to. Tax Code Section 1122 provides a partial exemption for any property owned by a disabled veteran. Before applying for either you must first meet the following criteria.

In the past year there were proposals to reduce the estate tax exemptionmeaning lowering the amount after which individuals will need to pay a tax on their estate. The surviving spouse who remains unmarried and surviving children of a disabled veteran may also qualify for an exemption under this section. The amount of the exemption varies depending on the disabled veterans disability rating.

Individuals age 65 or older or disabled residence homestead owners qualify for a 10000 residence homestead exemption for school district taxes in addition to the 40000 exemption for all homeowners. There are two kinds of homestead exemptions available to qualifying homeowners. Eligible seniors will get a 10000 exemption for school district property taxes.

And 2 homestead exemption for taxes other than school taxes. The 2018 estate tax examption increase is only temporary so the base exemption amount is set to drop back down to 5 million adjusted for. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

But dont forget about federal estate taxes. This exemption can only be. Therefore there is no estate limit exemption or tax rates to be concerned about.

If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption for disabled. Effective January 1 2022 a Texas property tax exemption change will benefit new property owners by allowing the homestead exemption for a partial year. 2 Your home must be located in Texas.

Inherited residence homestead exemption. The exclusion is said to be unified because certain gifts transferred during a persons life will count against the total amount of transfers that can be made tax-free upon. A If land is sold or otherwise transferred to another person in a year in which the land receives an exemption under Section 1120a6 an additional tax is imposed on the land equal to the tax that would have been imposed on the land had the land been taxed for each of the five years preceding the year in which the sale or transfer occurs in which the land received an exemption.

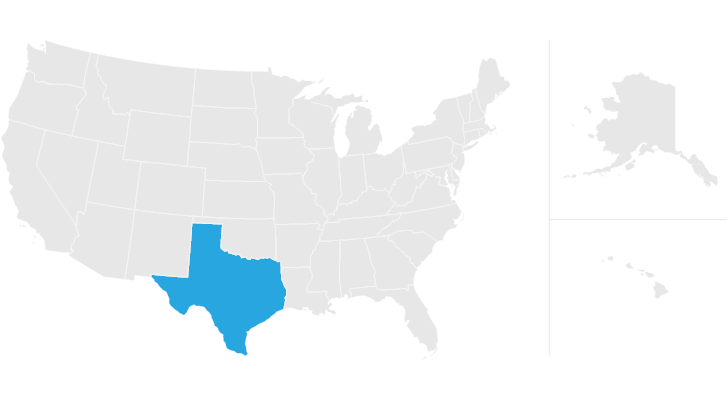

Senior or disability exemption. Reduction to the Estate Tax Exemption. The good news is that Texas does not have an estate tax.

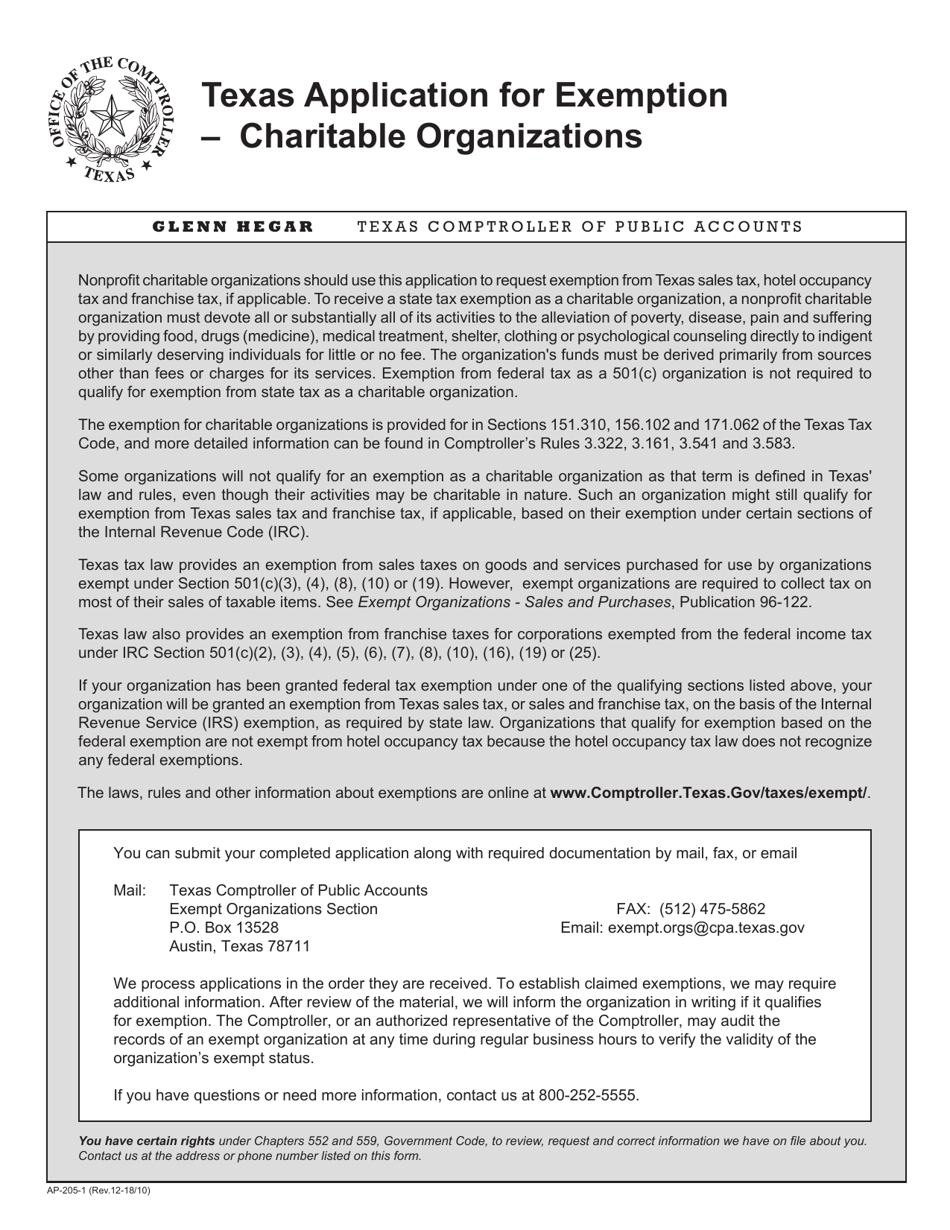

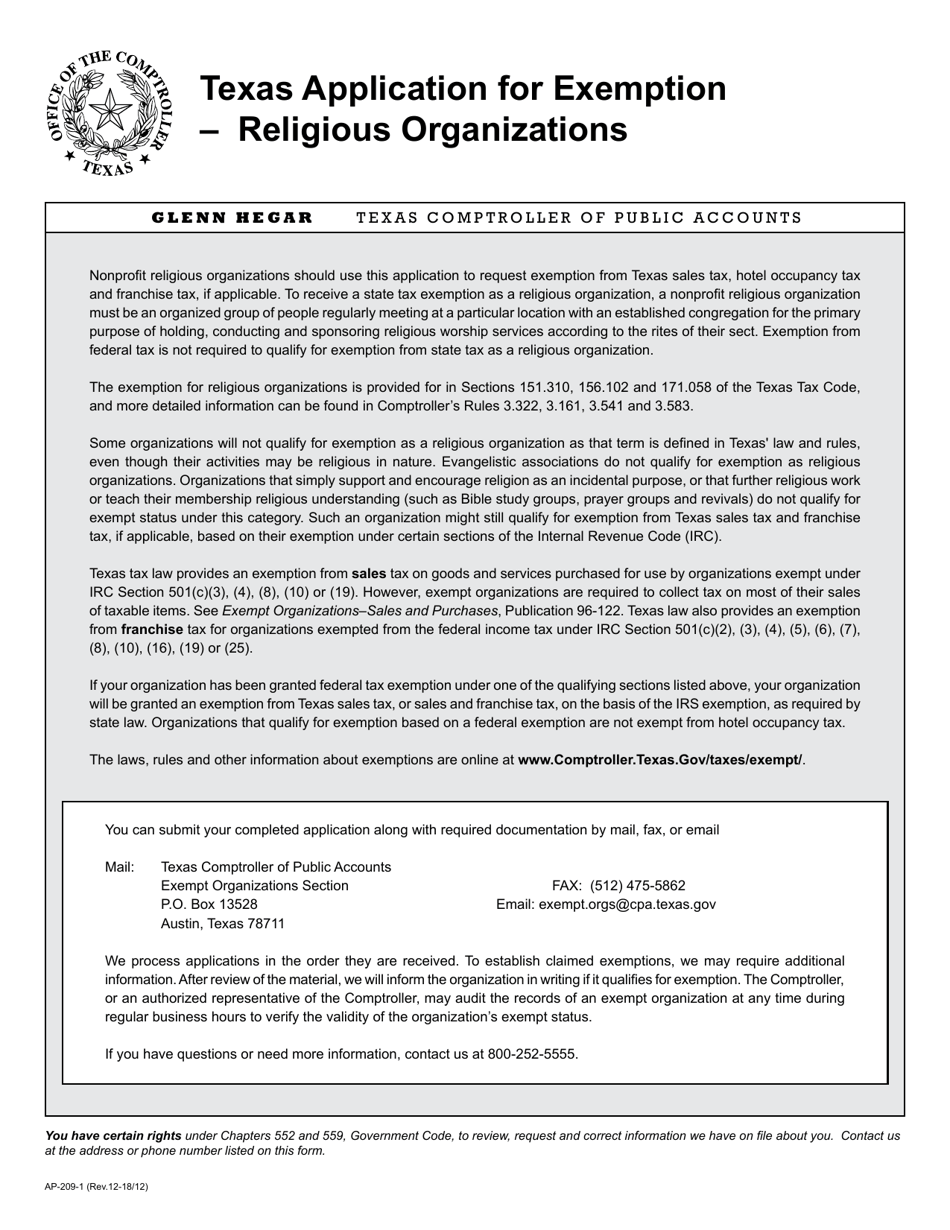

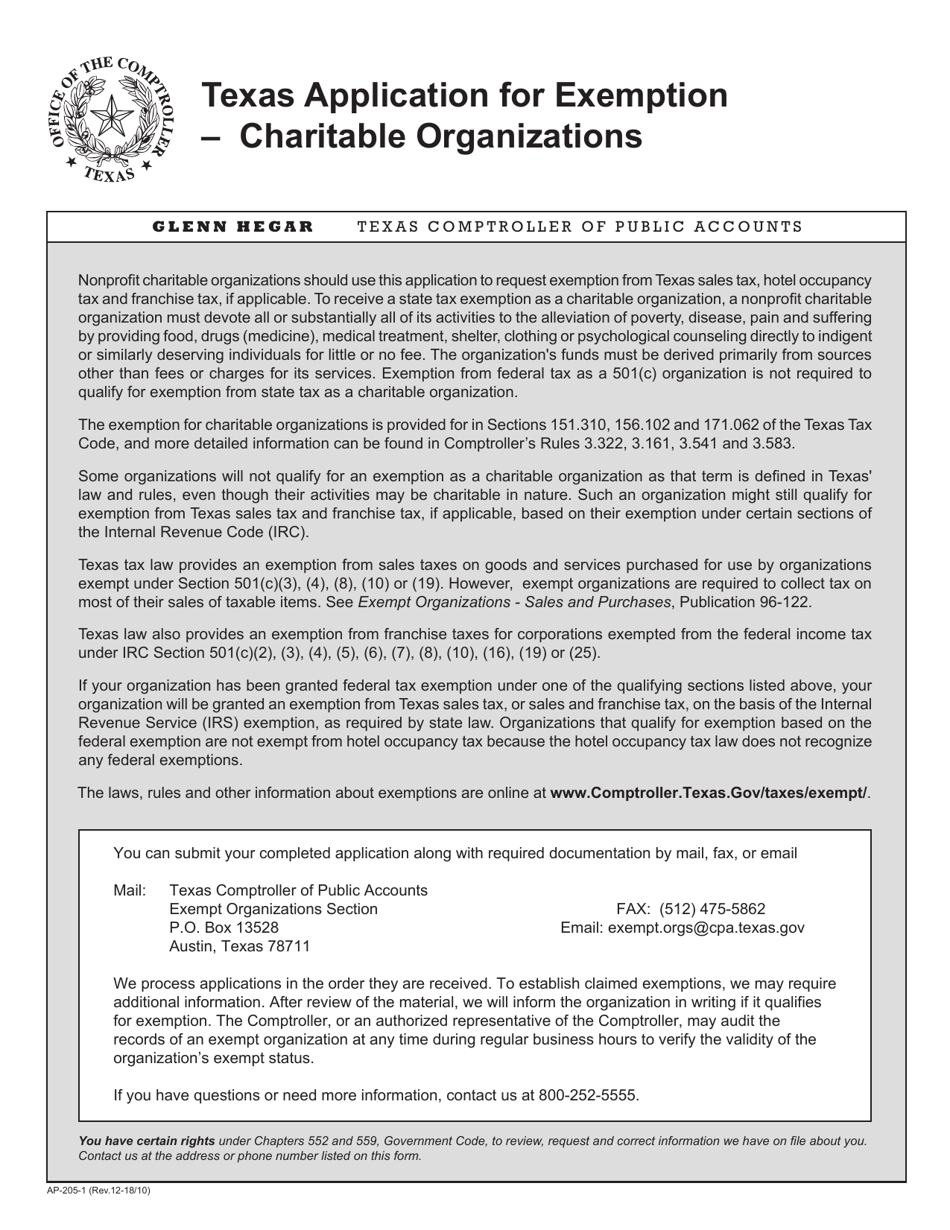

AP-209 Application for Exemption - Religious Organizations PDF AP-199 Application for Organizations Engaged Primarily in Performing Charitable Functions PDF AP-199-Addendum Application for Organizations Engaged Primarily in Performing Charitable Functions The addendum is only for a statewide organization that is submitting a list of its subordinate lodges. Agricultural property tax exemption. If an estate is valued over the exemption limit then the estate will be taxed before assets are distributed to beneficiaries.

However this past year there were proposals seeking to reduce the amount to 35 million per individual. This exemption will increase by 15000 to a 40000 school district exemption for the 2022 tax year with voter approval. A local organizing committee as defined in Article 519014 Vernons Texas Civil Statutes is exempt from sales franchise and the state portion of hotel occupancy taxes if it is exempt from federal income tax under IRC Section 501c and authorized by one or more endorsing municipalities or counties to pursue an application and submit a bid on the municipalitys or.

Tax Code Section 11131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US.

State Corporate Income Tax Rates And Brackets Tax Foundation

Form Ap 209 Download Fillable Pdf Or Fill Online Texas Application For Exemption Religious Organizations Texas Templateroller

Tx Comptroller 01 315 1991 2022 Fill Out Tax Template Online Us Legal Forms

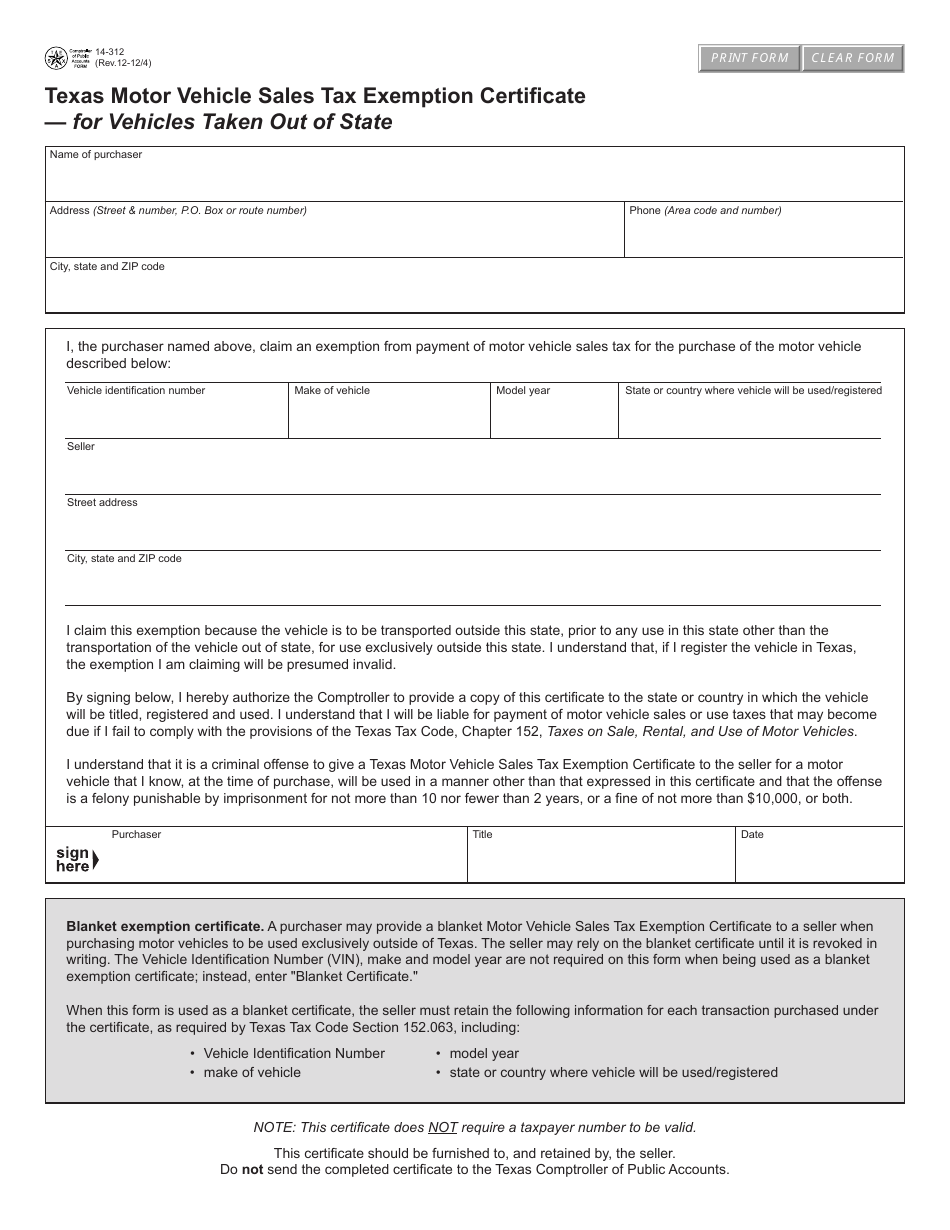

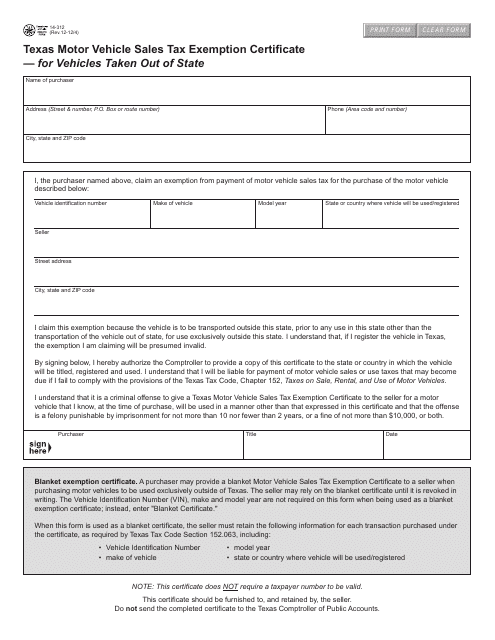

Form 14 312 Download Fillable Pdf Or Fill Online Texas Motor Vehicle Sales Tax Exemption Certificate For Vehicles Taken Out Of State Texas Templateroller

Texas Estate Tax Everything You Need To Know Smartasset

Form 14 312 Download Fillable Pdf Or Fill Online Texas Motor Vehicle Sales Tax Exemption Certificate For Vehicles Taken Out Of State Texas Templateroller

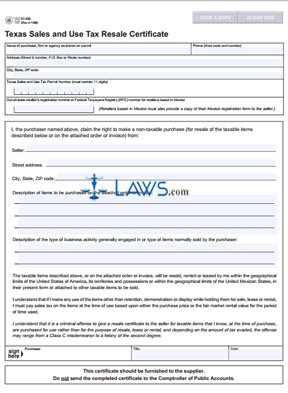

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

Texas Inheritance And Estate Taxes Ibekwe Law

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Texas Homestead Tax Exemption Cedar Park Texas Living

Tx Comptroller 12 302 2017 2022 Fill Out Tax Template Online Us Legal Forms

Is There An Inheritance Tax In Texas

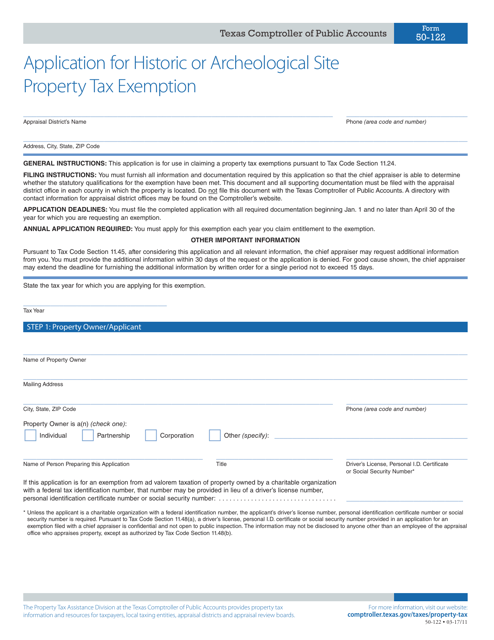

Form 50 122 Download Fillable Pdf Or Fill Online Application For Historic Or Archeological Site Property Tax Exemption Texas Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Form Ap 205 Download Fillable Pdf Or Fill Online Texas Application For Exemption Charitable Organizations Texas Templateroller

Texas Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms