non filing of service tax return

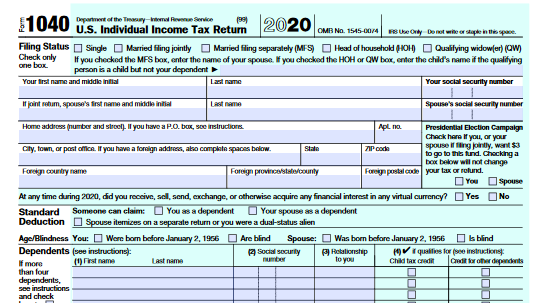

After Considering the above amendment the Maximum Penalty for Late Filing of Service Tax Return is been increased to 20000- Twenty Thousand wef. If assessee has not provided any Taxable Services during the period for which he is required to file the.

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

Make an appointment at your local taxpayer assistance.

. Section 234E provides that the person that is required to collectdeduct tax deducted at source will be liable to a penalty of Rs 200- two. Rs1000-Delay beyond 30 days. Non-Filing of TDSTCS Returns.

The Verification of Non-Filing Letter can be obtained from the IRS website using. ACES has started accepting Service Tax ST-3 returns for the period April to June 2012 revising the earlier forms by removing few bugs. Rs 100 per day for non or late filing of service tax returns.

Belated return under section 139 4 for the financial year 2021-22 can be filed at any time before the expiry of one year from the end of the relevant assessment year AY 2022. The late fee payable is as follows-Delay up to 15 days. Firstly with rigorous imprisonment which.

Unpaid tax is the total tax required to be shown on your return minus amounts paid through withholding estimated tax payments and allowed refundable credits. Penalty for late filing of Nil return - Held that- in view of the Boards Circular No97807-ST dated 23082007 in the event no service is rendered by the service provider there is no requirement. No taxpayer will be penalized for an amount greater than that.

Consequences of non-filing of Income Tax Return AO can issue notice us 1421 if the return is not filed before the time allowed us 1391. 2021 tax preparation software. In the case of any errors to be corrected or.

Mailing in a form. Efile your tax return directly to the IRS. Rs500-Beyond 15 days but up to 30 days.

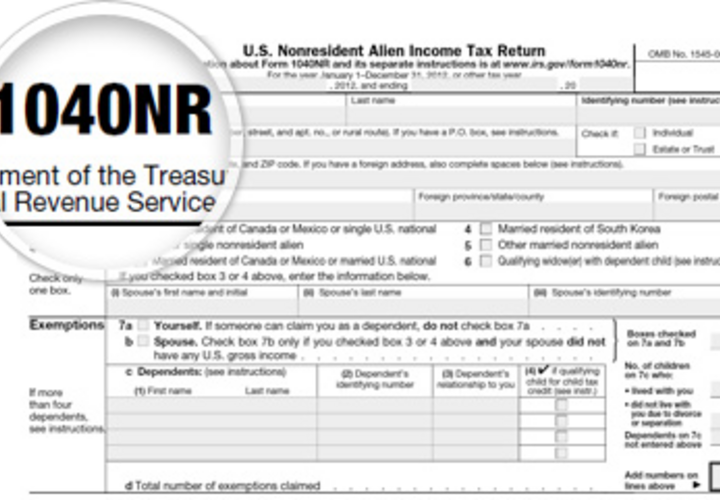

Non Tax filers can request an IRS Verification of nonfiling free of charge from the IRS in one of three ways. Rule 7B Service Tax Rules 1994 Filing of NIL Return of Service Tax. First know what the due date for Income Tax Return filing is.

The failure to file before concerned due date leads to face many consequences by the assessee. 1 Every assessee shall submit a half-yearly return in Form ST-3 or ST-3A as the case may be along with a copy of the Form TR-6 in triplicate for the months. Non filing of service tax return Service Tax Started By muthiah thangaraju Dated 18 2 2014 Last Replied Date 18 2 2014 WHETHER IS IT MANDATORY TO FILE NIL RETURN.

The extended time to file now is till 25th. In absence of valid service of. For the 2023-2024 academic year the Verification of Non-Filing Letter must be for the calendar year of 2021.

Rs 100 per day for non or late filing of service tax returns. Prepare federal and state income taxes online. Examination uses this procedure to establish an account and examine the records of a taxpayer when the taxpayer refuses or is unable to file and information received indicates.

2 days agoEven though the original federal tax return filing deadline for most people was on April 18 this year the due date for filing an extended return for the 2021 tax year is October 17. 100 Free Tax Filing. Rs1000- plus Rs100- per day for delay beyond 30 days from.

3 hours agoThe Internal Revenue Service is keeping its Free File program open an extra month which extends the time for eligible people to claim COVID stimulus payments including the. As per section 276C if a person wilfully attempts to evade tax penalty or interest or under-reports his income then he shall be punished. The assessee will have to file NIL Return as long as the Registration of the asseesee remains and is not cancelled.

The due date is fast approaching so you should file the return well in time to avoid late fees and penalty. The maximum penalty for late filing of service tax return is Rs 20000.

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Irs Will Refund 1 2 Billion In Late Tax Filing Penalties To 1 6 Million Taxpayers Upi Com

Why Teenagers Should File A Tax Return Money

Tax Day 2021 You Can File A Basic Federal Tax Return For Free Verifythis Com

What Happens If A Corporation Does Not File A Tax Return When It Owes No Taxes

No April 15th Tax Filing Deadline Changed For 2022 Al Com

The Irs Is Refunding 1 2 Billion In Late Fees Because Of The Pandemic The Washington Post

Filing An Amended Individual Tax Return Gyf

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

Irs Important Considerations Before Filing A 2021 Tax Return Mychesco

When Is A Tax Return Considered Filed With The Irs

Oct 15 Is Tax Deadline For Extended 2020 Tax Returns

How To File A Zero Income Tax Return 11 Steps With Pictures

U S Taxes Office Of International Students Scholars

Md Tax Day 2019 Late Filing Tips Postal Hours Annapolis Md Patch

Non Filing Of Service Tax Return Email Notice Solutions Myonlineca